Looking to Buy Your Dream Home?

Welcome to my buyers page, dedicated in helping you make one of the biggest purchase you will ever make. Providing a comprehensive game plan, with a helpful checklist to keep you informed throughout the process, and ensure you’re aware of a realtor’s fiduciary duties. We work with real data to assist you in making an informed decision.

Buy a home with Jay Bru Group.

Looking for a property to buy for living or investments?

1. Submit Your Info

Enter your information in the web form given

2. We’ll Give You A Call

You will be contacted by a our Real Estate Specialist

3. Game Plan

What are the “Must-Haves” for your new home?

4. Find & Close

Target potential homes and find that Dream Home!

REQUEST CONSULTATION

Your information is safe & secure

Discover the Benefits of Choosing Us for Your Real Estate Journey

We want you to feel that you have been treated fairly in the process

Effective March 17th, 2024, the National Association of Realtors (NAR) concluded its legal effort to maintain the century-old commission payment structure, resulting in significant changes to how buyer and seller commissions are structured. Starting in July 2024, the method for compensating commissions will undergo a transformation. The full implications of this adjustment will unfold over time, yet it represents a pivotal shift towards fostering more professional and transparent relationships between buyers and their agents. As a dedicated buyer's agent, I view this evolution in commission payment structures as an opportunity to enhance the quality and integrity of our services. Moving forward, our compensation will be based on a professional contractual agreement, directly aligning with our commitment to serve your interests. This change underscores our pledge to transparency, ensuring that sellers are responsible for my fee, thus maintaining our focus on securing the best possible outcomes for our clients. This revised paragraph communicates the changes in a clear, professional manner, emphasizing the benefits and the agent's commitment to transparency and client-focused service.

*Get a home warranty for a year included, so you don’t have to worry about unexpected expenses.

*You won’t overpay for a property! We give you a professional analysis of the property value and negotiate a better price than its fair value. Click here

*Transparency! Everything will be explained, and the costs will be transparent upfront.

*When you sign a buyer-broker professional relationship, contract with me, you will have access to MLS listings and every house available including pocket listings, FSBO, off-market, and investor-friendly.

*We owe you Fiduciary Duties: Loyalty, confidentiality, disclosure, obedience, reasonable care, diligence, accounting, and accounting. We take our job seriously!

*Save money! We secure the best prices on interest rates, closing costs, and repairs by obtaining multiple quotes, plus exclusive discounts from our trusted lenders and title companies. We also work with inspectors and contractors to help you navigate the final stages of the process.

What We Can Do For You!

PROPERTY ADVICE

Friendly, free, no-obligation advice on what we do as licensed realtors, your subject home value, how negotiation works to get a better price, contracts, the escrow process, and what's at stake on the condition of the home.

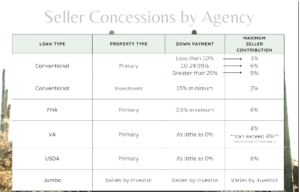

Save on your down payment through Seller Concessions

Buying / Selling at the same time

We have been there before. When downsizing or upsizing, we can help you buy and sell a property at the same time, with many options.

Home Warranty guaranteed

We can help alleviate your stress by ensuring that your new home is in good working order and is structurally sound. Our recommendations include various inspections and the procurement of a home warranty that provides protection for a full year!

Your checklist before you buy your home

The time has come, and you are ready to buy but review this checklist before searching for your next home. This list helps you prepare your budget in advance and guide you to financial success in the future.

This will give you a starting point for understanding your credit score before you request a loan. Your credit score will influence the interest rate of your loan.

While most people purchase a home without a 20% down payment, getting as close as possible is best. This will allow you to have a lower mortgage rate, Avoid PMI, and receive a better rate. You can still qualify for a Conventional if you do not have a 20% down payment—VA or FHA loan.

It’s not the list price included in the purchase. Remember there are inspection fees, earnest fees, moving expenses, and typically new furniture purchases that you should prepare for in advance. You should also be aware of your monthly budget along with the initial moving expenses. With homeownership comes property taxes, HOAs, insurance, and more. You want to make sure you are prepared for future budgeting as well.

Your preapproval can help if you are putting in an offer against someone who is not…makes you look like a more ready buyer. Your pre-approval is based on your income, debt, and credit history, and this is different from prequalification, which is how a lender determines how much you can afford. Text me, “can you recommend someone to help me with a mortgage?”

By getting your finances in line before your first home showing, you know the price range of a home you can afford. Setting a realistic budget that fits your income level and the characteristics you want in a home is essential.

An agent will be able to guide you along the way and educate you in the home-buying process. Finding a home is a joint venture with other professionals, and we are connected to many people that can help.

What Can Go Wrong at Closing?

Here are potential issues that could arise during a home purchase. Make sure you hire a licensed realtor to avoid these issues.

Can break down due to lack of maintenance, or hidden pre-existing issues, leading to costly repairs or replacement.

May deteriorate over time due to weather, wear and tear, or neglect by previous homeowners, causing leaks and structural problems.

Leaks or clogs can occur from worn-out pipes, poor maintenance, or concealed issues that may surface after purchase.

May fail due to lack of maintenance, resulting in cold showers and unexpected expenses to replace it.

Issues might arise from outdated wiring, overloaded circuits, or unsafe DIY modifications, posing safety hazards.

Clogs or damage may develop over time, often due to tree roots invading pipes or general wear and tear.

Infestations can occur in damp, poorly ventilated areas, often due to water leaks or inadequate ventilation, and may remain hidden until after purchase.

Can result from your credit score, market conditions, or lender practices, leading to higher monthly payments.

They may offer unfavorable terms, hidden fees, or pressure you into a quick sale.

Some real estate agents may not strictly adhere to ethical standards, potentially prioritizing their interests over yours.

If your realtor does not fulfill their fiduciary duty, they may not act in your best interests during negotiations or transactions.

Can occur if you’re not well-informed about the market or if you’re caught up in a competitive bidding situation.

Loyalty

Confidentiality

Disclosure

Obedience

Reasonable care and diligence

Accounting

Have you ever felt pressured by a real estate agent telling you,

We’re here to assist you in making informed decisions by providing REAL DATA about the area in your local housing market!

Exploring Local Market Data

Delve into tools and resources that provide insights on median home prices, sales volumes, and inventory levels.

Understanding Neighborhoods

Every area is unique! Consider future development plans, crime rates, school rankings, and access to public services during your research.

Ultimately, empower yourself with knowledge! Stay immune to pressure and instead, make an informed decision that aligns with your financial and personal circumstances.

Decoding the Housing Market: Your Guide to

How We Use Data to Help You Make an Informed Decision

Let’s understand your financial situation, including your budget and down payment capabilities.

I’m all about a data-driven approach rather than simply pushing you to buy a home. We’ll dive deep into a comprehensive analysis of the local real estate market, trends, and median prices. This gives you a clear picture and helps you make informed choices.

I’ll share important market data and statistics with you, covering median home prices, average days on market, and recent sales in your preferred neighborhoods. This information will help us set realistic expectations.

Together, we’ll work on strategies to make competitive offers based on our market analysis. I’ll explain why offering a specific price or negotiating certain terms is in your best interest.

I emphasize a data-driven approach in my marketing materials and when we discuss your options. I love sharing my knowledge of the local market and its unique aspects. It’s all about the significance of data, research, and market knowledge, making you feel confident that your decisions are based on factual information.

Feel free to ask questions and express your concerns. Let’s keep the communication open and honest. Your input is invaluable, and I’m here to adapt and cater to your needs.

We take our job seriously!

As you begin finding your next home checking these items off your list will provide you with a more successful home-buying experience. Our team is here to help you! Please give us your criteria for your area, home type, and what you need for your family. Our team of professionals will assist you with finding your next home.

Call or text me at 480-466-4917 or send me an email at jay@jaybrugroup.com

Jay Bru

REAL ESTATE NEWS

Stay up to date with Real Estate News, market changes & more...

National association of Realtors Lawsuit and change to how commissions are paid.

Here is an explanation of the new laws that will be taking place over the coming years with how realtors work and get paid.

March 2024 Arizona Real Estate Market Update

March 2024 RE Market Update Click here for the latest Charts from the Cromford Report Welcome to my blog on the AZ Real Estate market,

Hiring and Managing Contractors Made Easy (Checklist & Tips)

Got a home repair on your hands? Sometimes, it’s better to bring in the experts. Here’s a simple guide to help you pick and manage the right folks for the job.