This is an important question you should be asking yourself, along with your spouse, your parents, and friends before making a decision to buy or rent the home you live in. One of the biggest expenses and investments of your life.

I have thought about this topic many times over the course of the past few years, buying my first home when I was 22 and then living in a variety of living spaces like condo’s, big homes, small homes, furnished rentals, 3 different countries but I’ve mainly lived in my own home most of my life until recent. I’ve made most of my money owning personal homes and rental properties but I recently watched a Grant Cardone video that questioned the topic a little depending on where you live and what your circumstances are. The link for his video is at the bottom of this blog.

Before I go any further you need some sort of cash or financing and you need to live in your home for a min of 3-5 years for it to make sense. The last few years of appreciation in Arizona would say otherwise but if your limited on time here are some key points so you can decide right off the bat because there are so many situations in life to take all into consideration.

You should buy if:

- You’re comfortable with the downpayment and the payments per month.

- You know you will live there for 3-5 years

- You can’t deal with landlords or management companies.

- You like to be able to renovate and be able to improve the home.

- You’re in an appreciating market.

- You can get reasonable financing like below 4-5%

You should rent if:

- You don’t know where you will be in 2 years

- You don’t have a stable income

- You’re in an unstable relationship

- You don’t have the down payment

- You have a good investment lined up where you could put your extra capital.

Your lifestyle

Becoming a homeowner means committing to fixing the leaky roof, backed up toilet or heat pump that stops working on the coldest night of the year. Some people just don’t want the responsibility. Renters can pick up the phone and call the landlord. Landlords also tend to pick up the tab for utilities, trash pick up and landscaping. So if you’re not that handy, you may consider renting.

Also, consider the source of your income. If your paychecks aren’t steady or your job security is uncertain, it might make sense to hold off on buying a home. Renters can always pick up and move to cut back or follow a new job.

First things first, I found this handy calculator that can tell you what you should do. But there’s a lot more to it than calculations:

Go to this Website for the calculator, click here

Know your numbers

Lenders use a three-digit number called a credit score to decide whether to lend you money, so you need to know what yours is before you start house-hunting. The higher your score, the more likely you are to get to get a loan and a lower interest rate. There are three major credit reporting companies, and federal law mandates they each give one free report, once a year. You can check your reports for free here. You can also order your credit score while you review your report, though there could be fees. Many credit card companies offer free credit scores, so check with your bank first.

To help make a renting vs buying a home comparison, Fidelity recommended running a simple price-to-rent ratio: divide a home price by the annual rent of a comparable rental unit. If the ratio is less than 20%, buying is probably a better bet.

- How long do you plan to stay? Min 3-5 years, the more years makes it more sense to buy.

- Look for calculators that include things like insurance, maintenance, home price appreciation and selling costs to paint an entire picture, like this one https://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html

- In many cities the favor tips to buyers in as little as two years, while in more expensive cities it can take closer to 10 years. The golden rule is 3-5 years. Or buy a home that can be then turned into a rental or Airbnb.

- Homeowners are 36-44 more X’s wealthier than renters depending on what website you look at.

- Here is a link to help you decide to buy or rent. Related: Your step by step guide to becoming a homeowner

- When you buy, you forced yourself to save money. Renting you can blow it.

- If you can find an investment that pays 8-10% consecutively, it might be better to put your money there rather than a down payment..

- Owning a home creates stability for kids and families.

- There is a tax advantage to owning a home, check with your local CPA

- Homeownership makes people feel proud. Owning a home gives you the freedom to do whatever you like to it.

- Owning a home is best for pets.

Here is why the last 5 years have been a good idea to buy real estate in Arizona

Sample Calculation for how you can make major money in Arizona just by putting a roof over your head!!

Why Phoenix Arizona is a good investment, place to live, and why people are moving here!

The Argument for Renting:

Grant Cardone believes you should rent your home and invest where the money makes sense, here are his calculations.

Watch this video for his reasoning. https://youtu.be/ppFeFNpyH4M

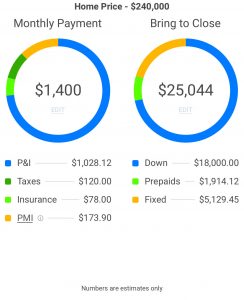

EX: Comparison to Buy a $240,000 house or Rent for $1200/month (if the the places are comparable)

- Down payments $18,000 (7.5% down with private mortgage insurance of $173.90 per month)

- Bring to close $25,044 (closing fee’s etc)

- The interest rate on a mortgage 5-6% ( He uses a higher interest rate then in today’s world)

- Prop Taxes 2% per year (AZ is cheaper than this)

- Mobility lost min 10-14 months

- Suggests there are four million homes foreclosed on in 2010, which can be avoided by renting.

- 8% of all homes still underwater today total of 5M with negative equity.

- Pay 7-8% per year with interest rates and taxes. And then an additional 5-6 % to sell the house with closing costs.

- He suggests you rent, then take that money and invest into multi-family or investment homes where the rent to price ratio is better otherwise you may have to live in the hood.

- He believes in mobility and lifestyle where renting you can be mobile and move. If you own, you are stuck there for 3-5 years min to make sense.

(Figures using the Lawyers title app)

There are many different factors when considering renting vs buying such as mobility, family, investments, employment, pride in ownership, relationships, and stress. Run the numbers, go to the calculators, click the renting vs buying links, and call me to help you decide. I want what’s best for you! Have a great day!

Jay Bru

480-466-4917