Forbearance and Foreclosures in 2020

As of the end of 2020, about five and a half percent of active mortgages—about 2.7 million loans—were in the forbearance program, down from over 8% at its peak in March. That represents a large number of borrowers for services to deal with as they exit the program, but it doesn’t necessarily mean that an equally large number of foreclosures will follow.

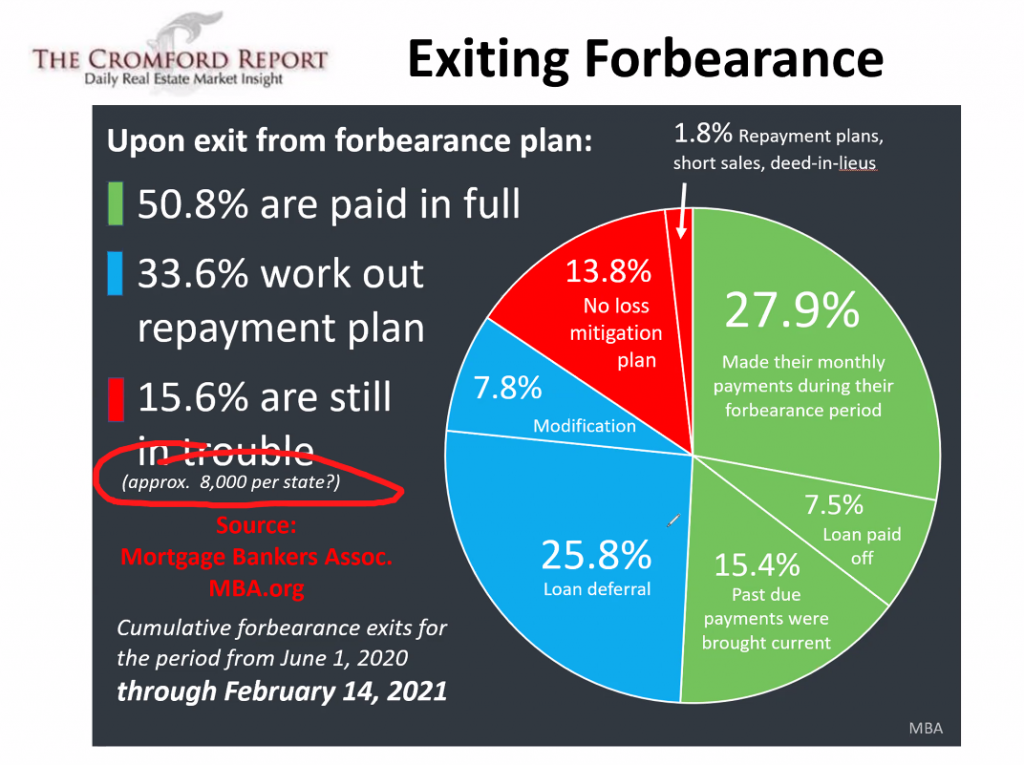

The data, in fact, suggest just the opposite: as people have exited forbearance, they’ve done so successfully. According to Mortgage Bankers Association research, from July 2020 when borrowers began exiting the program through the end of the year, about 87% of them did so with a repayment plan in place, their loans reinstated, their missing payments deferred to the end of the loan, paid off the loan, or had a loan modification in place—all positive outcomes.

The remaining 13% of homeowners who left the program without a repayment plan of some sort in place are the ones who are probably most at risk of going into default. If these numbers remain consistent, about 325,000 people will exit the forbearance program over the next six to nine months without a plan in place. Some—but probably not all—of those loans will likely default.

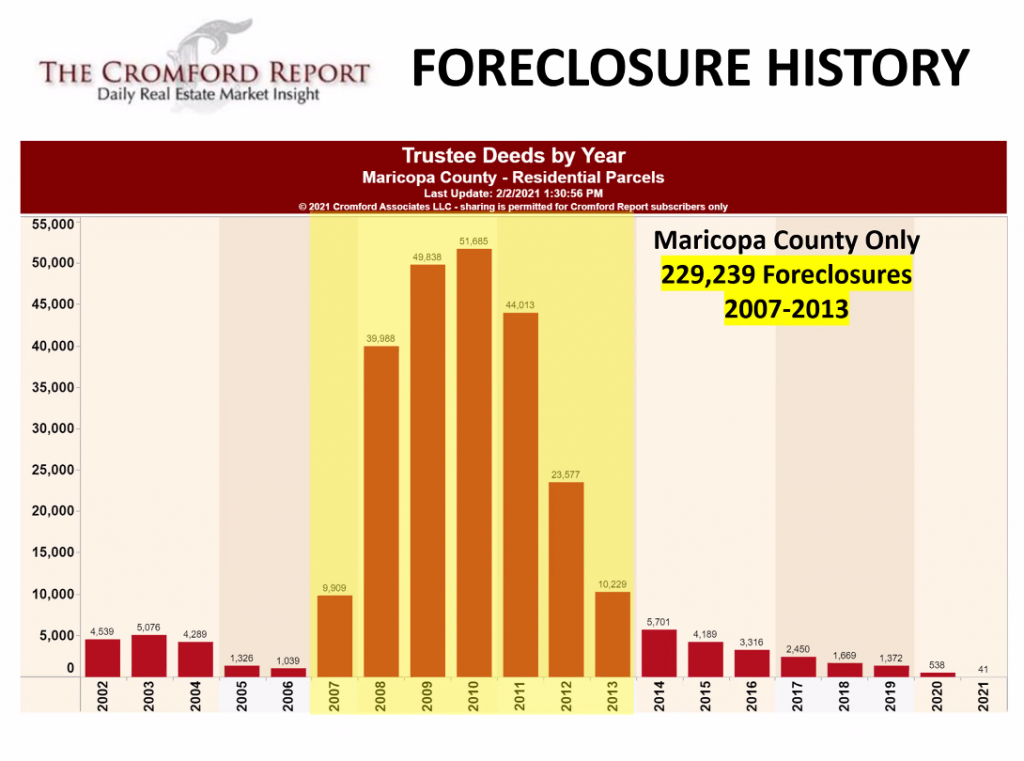

Prior to the pandemic, foreclosure activity was running at about half of its normal rate. In a normal year, about 1% of loans are in some stage of foreclosure. In early 2020, it was between 0.5% and 0.6%, so loan quality was very high and loan performance was twice as good as normal. There were about a quarter-million loans in foreclosure when the pandemic hit. Presumably, most of them have been protected by the moratoria but all of those will eventually be coming back into the pipeline pretty rapidly once the moratoria are lifted.

What’s Different in 2021?

That said, suggesting that there won’t be a significant increase in default activity in 2021 would be silly. It’s almost impossible to see a scenario where 40 million Americans lose their jobs and foreclosure rates don’t increase. As we move through 2021, there are a number of things that could inflate the number of defaults.

- Unemployment

- Commercial Defaults

- The Rental Market

Why Defaults May Not Lead to Foreclosures

When borrowers default on a loan, it’s not unusual for the default to be resolved before the foreclosure. Loans are re-instated or refinanced, or the property is sold and the debt retired before the foreclosure auction. For financially distressed homeowners today, market dynamics provide a much better environment than what we saw during the last recession.

A primary difference this time is that homeowner equity is at an all-time high: over $6.5 trillion. According to RealtyTrac’s parent company ATTOM Data, about 70% of homeowners have more than 20% equity. Other published research has indicated that more than 90% of borrowers in forbearance have more than 10% equity in their properties. Homeowners with ample equity in a housing market characterized by historically low inventory of homes for sale, historically low mortgage rates and strong demand should be able to sell their properties—perhaps at a modest discount—in order to avoid a foreclosure. So even as we see the number of defaults increase as the forbearance program ends and foreclosure moratoria eventually expire, the record level of homeowner equity means that the overwhelming majority of distressed assets are likely to be sold well before the foreclosure auction.

Those same market dynamics also favor mortgage servicers and noteholders who find that foreclosure is the only option for some of their borrowers. Investors are eager to purchase properties at foreclosure auctions or as REO assets on the open market, and use sites like RealtyTrac to find, analyze, and target properties they plan to fix-and-flip or buy-and-rent. Competition between traditional homebuyers, individual investors, and institutional investors should drive up sales prices and shorten hold times, which helps servicers minimize losses for their clients.

The biggest challenge for default servicing professionals is going to be effectively managing the enormous volume of borrower contacts—and the subsequent loss mitigation processes associated with millions of delinquent loans—once the government moratoria and forbearance programs expire. Staying compliant with frequently changing state and local foreclosure regulations will add a layer of complexity as well.

The bottom line is that although the number of foreclosures is unlikely to approach, there’s a huge wave of default activity coming that will wipe out servicers who don’t plan ahead and make sure they have the people, processes, and technical resources ready to meet the challenge.

4 Major Reasons Households in Forbearance Won’t Lose Their Homes to Foreclosure

There has been a lot of discussion as to what will happen once the 2.3 million households currently in forbearance no longer have the protection of the program. Some assume there could potentially be millions of foreclosures ready to hit the market. However, there are four reasons that won’t happen.

1. Almost 50% Leave Forbearance Already Caught Up on Payments

According to the Mortgage Bankers Association (MBA), data through March 28 show that 48.9% of homeowners who have already left the program were current on their mortgage payments when they exited.

- 26.6% made their monthly payments during their forbearance period

- 14.7% brought past due payments current

- 7.6% paid off their loan in full

This doesn’t mean that the over two million still in the plan will exit exactly the same way. It does, however, give us some insight into the possibilities.

2. The Banks Don’t Want the Houses Back

Banks have learned lessons from the crash of 2008. Lending institutions don’t want the headaches of managing foreclosed properties. This time, they’re working with homeowners to help them stay in their homes.

As an example, about 50% of all mortgages are backed by the Federal Housing Finance Agency (FHFA). In 2008, the FHFA offered 208,000 homeowners some form of Home Retention Action, which are options offered to a borrower who has the financial ability to enter a workout option and wants to stay in their home. Home retention options include temporary forbearances, repayment plans, loan modifications, or partial loan deferrals. These helped delinquent borrowers stay in their homes. Over the past year, the FHFA has offered that same protection to over one million homeowners.

Today, almost all lending institutions are working with their borrowers. The report from the MBA reveals that of those homeowners who have left forbearance,

- 35.5% have worked out a repayment plan with their lender

- 26.5% were granted a loan deferral where a borrower does not have to pay the lender interest or principal on a loan for an agreed-to period of time

- 9% were given a loan modification

3. There Is No Political Will to Foreclose on These Households

The government also seems determined not to let individuals or families lose their homes. Bloomberg recently reported:

“Mortgage companies could face penalties if they don’t take steps to prevent a deluge of foreclosures that threatens to hit the housing market later this year, a U.S. regulator said. The Consumer Financial Protection Bureau (CFPB) warning is tied to forbearance relief that’s allowed millions of borrowers to delay their mortgage payments due to the pandemic…mortgage servicers should start reaching out to affected homeowners now to advise them on ways they can modify their loans.”

The CFPB is proposing a new set of guidelines to ensure people will be able to retain their homes. Here are the major points in the proposal:

- The proposed rule would provide a special pre-foreclosure review period that would generally prohibit servicers from starting foreclosure until after December 31, 2021.

- The proposed rule would permit servicers to offer certain streamlined loan modification options to borrowers with COVID-19-related hardships based on the evaluation of an incomplete application.

- The proposal rule wants temporary changes to certain required servicer communications to make sure borrowers receive key information about their options at the appropriate time.

A final decision is yet to be made, and some do question whether the CFPB has the power to delay foreclosures. The entire report can be found here: Protections for Borrowers Affected by the COVID-19 Emergency Under the Real Estate Settlement Procedures Act (RESPA), Regulation X.

4. If All Else Fails, Homeowners Will Sell Their Homes Before a Foreclosure

Homeowners have record levels of equity today. According to the latest CoreLogic Home Equity Report, the average equity of mortgaged homes is currently $204,000. In addition, 38% of homes do not have a mortgage, so the level of equity available to today’s homeowners is significant.

Just like the banks, homeowners learned a lesson from the housing crash too.

“In the same way that grandparents and great grandparents were shaped by the Great Depression, much of the public today remembers the 2006 mortgage meltdown and the foreclosures, unemployment, and bank failures it created. No one with any sense wants to repeat that experience…and it may explain why so much real estate equity remains mortgage-free.”

What does that mean to the forbearance situation? According to Black Knight:

“Just one in ten homeowners in forbearance has less than 10% equity in their home, typically the minimum necessary to be able to sell through traditional real estate channels to avoid foreclosure.”

Bottom Line

The reports of massive foreclosures about to come to the market are highly exaggerated. As Ivy Zelman, Chief Executive Officer of Zelman & Associates with roughly 30 years of experience covering housing and housing-related industries, recently proclaimed:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

Hope this helps clear out some of your questions about forbearance and foreclosures!

Jay Bru

480-466-4917

jay@jaybrugroup.com